A blockchain is a database that lives across a network of computers rather than on one server. No single person or organization owns it. Every computer, or node, stores a complete record of every transaction, so no one can control or destroy the network without first taking over a majority of the nodes. This makes it impossible for anyone to manipulate the database, say by giving themselves more tokens. Every change and transaction is logged on the chain

Inside the Web3 Revolution: Paradise at the Crypto Arcade

The new movement wants to free us from Big Tech and exploitative capitalism—using only the blockchain, game theory, and code. What could possibly go wrong?

It's getting late on a Saturday afternoon in Denver when I lean back and take in the full weirdness of what I’m doing. I’m seated at a long plastic folding table against the wall in a windowless room, a Discord server open on my laptop. Pizza crusts and empty potato chip bags are piled up around me, evidence of the feverish hours I’ve spent hacking together a project with a trio of blockchain developers. I’m not a programmer, just a journalist with a law degree. Yet somehow I’ve gotten swept up in creating my own DAO—a decentralized autonomous organization, a favorite concept among the starry-eyed proponents of Web3—and it’s supposed to launch tomorrow.

No doubt you have questions. So do I. Like: What happened to me? Three days ago I was a crypto skeptic who could barely figure out how to buy ether. Now I’m speaking in complete sentences about multisig treasuries and quadratic voting. The devs have almost integrated our site with non-MetaMask wallets, and I’ve just dropped $85 for a domain on the Ethereum Name Service despite having no clear use for it. And rather than feeling exasperated or baffled, I seem to have caught the same thrill, however fleetingly, as everyone around me.

I am among the estimated 10,000 people who arrived in Colorado a few days ago for this year’s ETHDenver conference, the biggest and oldest event in the world of Ethereum and Web3. Most of these folks came here to be among their people. I came to try to understand them. And I think I finally do.

The term Web3, as you may or may not have noticed, emerged from obscurity last year, buoyed by rising cryptocurrency prices and some canny marketing by venture capitalists. Its meaning is hard to pin down. In the media and on Twitter, Web3 has become a catchall for anything having to do with blockchains and cryptocurrency: People paying tens of thousands of dollars for digital collectibles known as non-fungible tokens, or NFTs, with neither practical nor aesthetic value, then flipping them for even ungodlier sums. “Play-to-earn” video games that lure gamers into flimsy virtual worlds with the promise of riches. Celebrities shilling crypto exchanges during the Super Bowl. A ceaseless parade of scams, hacks, and frauds.

But to a core of true believers, Web3 stands apart from the garish excesses and brazen misbehavior of the flashing-neon crypto casino. If cryptocurrency was originally about decentralizing money, Web3 is about decentralizing … everything. Its mission is almost achingly idealistic: to free humanity not only from Big Tech domination but also from exploitative capitalism itself—and to do it purely through code.

Bitcoin, the original blockchain-based cryptocurrency, created a way to send and receive digital money without needing a bank to approve those transactions. Instead of regulators and cops, a set of carefully designed incentives would, in theory, keep everyone acting in the best interests of all Bitcoin users. Web3 aims to apply these two concepts—decentralization and game theory—to all of digital life. The main vehicle for this is Ethereum, a blockchain that borrowed Bitcoin’s key features and added a major innovation: It was designed with its own programming language so developers could build apps, and eventually a whole new decentralized digital infrastructure, to run on it.

If Bitcoin attracts anarcho-capitalists who want to dethrone the central bankers, the culture around Ethereum and Web3 has a more progressive bent. After I walked into the Denver Sports Castle, a massive former sporting goods store turned events space that served as ETHDenver’s main venue, the first panel I caught was about using blockchains to build “public goods.” Another was titled “Navigating the Web3 Workforce as a BIPOC, Queer, Marginalized Individual.” (The overall crowd skewed heavily white and male.) Aesthetically, ETHDenver embraced a spirit of collaborative, LARPish make-believe; there was quite a bit of talk about the Bufficorn, the cartoon buffalo-unicorn hybrid that was the event’s NFT mascot. (It fuses the magic of the unicorn with the strength of the buffalo.) People communicated with all manner of cheerful memes: gm, for “good morning,” was the universal greeting, regardless of the time of day; wagmi meant “we’re all gonna make it.”

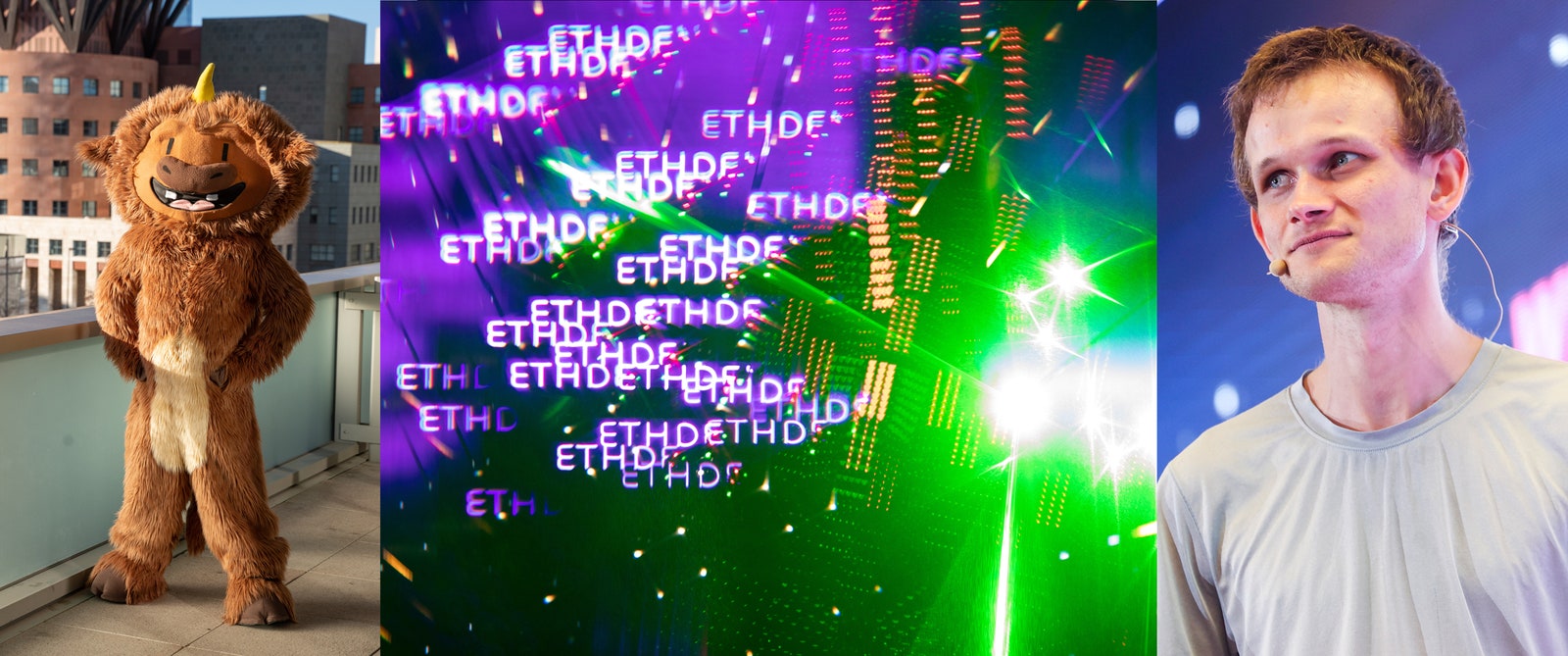

The Bufficorn, ETHDenver's mascot, and Vitalik Buterin, creator of Ethereum.

Photographs: Jesse Morgan/ETHDenver; Alexandra Masihy/ETH Denver; Michael Ciaglo/Getty Images

During the opening ceremony, the conference organizers emphasized Web3’s idealism. “It’s not about money,” said John Paller, founder of ETHDenver. “We don’t care about that.” The theme of the conference, he explained, was “BUIDLing.” The term, which everyone pronounced “biddling,” is a riff on the crypto meme “HODLing”—holding one’s assets no matter how grim the market looks, as an expression of faith in its long-term value. (In crypto, as in all internet culture, typos are a rich source of memes.) “BUIDL is the rally cry of the Bufficorn,” Paller said.

What exactly were they BUIDLing? It’s easy to find brilliant, idealistic, experienced technology experts who think Web3 is pure nonsense. But it’s almost as easy to find ones who think it’s the real deal—humanity’s best chance of redeeming the entire promise of the internet.

One way to think about Web3 is right there in the name: It’s the successor to Web 2.0, the era that was supposed to democratize the internet but instead became dominated by a handful of huge platforms, like Google and Facebook. Web3 is about re-decentralizing the web.

From its Darpa-funded infancy, the internet was designed to be decentralized. This had a very practical Cold War–era purpose: A network of computers spread around the country couldn’t be wiped out in a single nuclear blast. Early enthusiasts also saw in this distributed structure an inherently liberating tendency, a spirit captured in John Gilmore’s famous 1993 dictum, “The Net interprets censorship as damage and routes around it.”

As the 1990s wore on, however, the dream of decentralization frayed. During what would later be dubbed the Web 1.0 era, the typical internet user, though theoretically empowered to create web pages, was in practice doing little more than viewing those made by others. And as a mature economy developed around the internet, powerful companies began to centralize on top of its open protocols—like Microsoft using its operating system monopoly to take over the browser market with Internet Explorer. Then came the dotcom crash, which called into question whether the internet would ever fulfill its potential.

Hope reemerged in the mid-2000s, when new platforms and technologies allowed ordinary users to create and upload content that could reach thousands or even millions of people. If Web 1.0 saw the masses passively consuming media created by publishers, in Web 2.0, the masses would be the creators: Wikipedia entries, Amazon product reviews, blog posts, YouTube videos, crowdfunding campaigns. Time captured the spirit of the moment with its 2006 Person of the Year selection: “You.”

But something very different was happening beneath the surface. User-generated content was free labor, and the platforms were the bosses. The big winners slurped up user data and used it, along with old-fashioned mergers and acquisitions, to build competitive moats around their businesses. Today, one company, Meta, owns three of the four largest social apps in the world, in terms of users. The fourth, YouTube, is owned by Google, which also accounts for around 90 percent of all internet searches. As these companies conquered more and more of the web, it became clear that the user was less a creative partner than a source of raw material to be perpetually harvested. Escape is difficult. Meta controls access to your Facebook and Instagram photos, plus your friend lists. Want to ditch Twitter or find a streaming alternative to YouTube? You can’t take your followers with you. And if a platform chooses to suspend or cancel your account, you have little recourse.

In hindsight, there’s no shortage of explanations for why Web 2.0 failed to deliver on its early promise. Network effects. The unforeseen power of big data. Corporate greed. None of these have gone away. So why should we expect anything new from Web3? For believers, the answer is simple: Blockchain is different.

Gavin Wood, an English computer scientist who helped program Ethereum, coined the term Web3 in 2014, the year Ethereum launched. (He first called it Web 3.0, but the decimal thing has since become passé.) In his view, Web 2.0’s fatal flaw was trust. Everyone had to trust the biggest platforms not to abuse their power as they grew. Few seemed to notice that Google’s famous early motto, “Don’t be evil,” implied that being evil was an option. To Wood, Web3 is about building systems that don’t rely on trusting people, corporations, or governments to make moral choices, but that instead render evil choices impossible. Blockchain is the crucial technology for making that happen. Brewster Kahle, the creator of the Internet Archive and the Wayback Machine, has described this goal as “locking the web open.” Or, as Chris Dixon, a general partner at Andreessen Horowitz’s crypto fund and a leading Web3 booster, puts it, “Can’t be evil > don’t be evil.”

A blockchain is a database that lives across a network of computers rather than on one server. No single person or organization owns it. Every computer, or node, stores a complete record of every transaction, so no one can control or destroy the network without first taking over a majority of the nodes. This makes it impossible for anyone to manipulate the database, say by giving themselves more tokens. Every change and transaction is logged on the chain, for all the world to see. There’s no central authority that must be trusted to enforce the rules.

So how exactly are blockchains supposed to lock the web open? Right now, platforms like Instagram and TikTok own the data that you generate while using them, store it on their servers, and make extracting it hard or impossible. In a Web3 world, the theory goes, your data would live on a blockchain, not a central server. Instead of platforms owning it, you would, controlling access to it via a private cryptographic key that only you possess. If you got tired of one service, you could take your data to another. And a platform couldn’t change the rules of the game by erecting walls around its data, because it would never have owned the data in the first place.

Innumerable Web3 startups are trying to apply this theory by creating blockchain-based alternatives to just about any platform you can name: Spotify, Twitter, Instagram, Google Docs. The liberal billionaire Frank McCourt has pledged $25 million toward developing a protocol for putting your social graph—the interlocking map of relationships that you’ve built up over the years but that is probably owned by Facebook—on the blockchain. A company called Sapien purports to be building an entire Web3 metaverse.

Faith in blockchain infrastructure as a forcing mechanism for decentralization is Web3’s first tenet. There are other tenets—but we’ll get to those later. Because the infrastructure is making some ominous creaking noises already.

On day two of ETHDenver, the toilets broke. The plumbing at the Sports Castle wasn’t ready for so many people. Ethereum has a similar problem. Like the Sports Castle, it can’t handle the load of transactions going through its pipes.

Ethereum, like Bitcoin, operates on a system known as “proof of work.” Computers in the network “mine” new tokens by being the first to solve complex math problems and get paid a fluctuating “gas fee” for verifying transactions on the blockchain. The more demand on the network, the higher the gas fee. Ethereum has grown so popular that gas fees are often prohibitively high. During its wild surge late last year, they topped $55 per transaction. The math problems also require a ton of electricity. By one estimate, if the world’s countries were ranked by energy consumption, the combined nation of Bitcoin and Ethereum would slot in between Italy and the United Kingdom. While many Bitcoiners shrug at this, Web3 proponents are torn up at the thought of contributing to the climate crisis.

It seemed like every third person at ETHDenver was working on some kind of fix for these issues. Ethereum’s core developers have long been trying to execute a shift to “proof of stake,” a more eco-friendly (but possibly less secure) alternative to proof of work, that after years of delay is supposed to launch this year. There are also competing blockchains that don’t use proof of work and thus don’t incur the environmental costs or gas fees of Ethereum. Then there are “Layer 2” blockchains that do most of the work on their own network before logging the results on Ethereum in big batches to lower the cost per transaction.

Beyond the bandwidth problems, there was broad agreement among the ETHDenver crowd that the technology is far too difficult to use. Doing anything in Web3 is unbelievably confusing. I needed help just to redeem my crypto lunch tokens when I checked in at the hotel. If you want to get anything done and aren’t a programmer, you end up just clicking “OK” on a bunch of prompts that you don’t understand. This is a great way to get ripped off. During the conference, word got around that a phishing attack was hitting OpenSea, the leading NFT marketplace. In the end, almost $2 million worth of NFTs would be stolen. So common are these episodes that the news hardly raised eyebrows.

Crypto’s user-unfriendliness puts tremendous pressure on the whole ecosystem to do the one thing it was designed not to do: centralize. In January, Moxie Marlinspike, a cryptographer and creator of the open source encrypted messaging app Signal, wrote an incisive takedown of Web3’s underlying premises on his personal blog. In it, Marlinspike argues that because most people crave convenience, centralized services always end up imposing themselves on top of decentralized technologies. In the early days of Web 1.0, some people thought “we’d all have our own web server with our own website, our own mail server for our own email,” he writes. “However—and I don’t think this can be emphasized enough—that is not what people want. People do not want to run their own servers.”

This pattern, Marlinspike points out, is already repeating itself in Web3. It’s quite cumbersome, if not impossible, for an app on your phone to interact directly with a blockchain. So almost all Web3 apps rely on one of two companies, Infura and Alchemy, to do that. Likewise the digital wallets that most people use to store their crypto assets. In other words, nearly every Web3 product relies on a middleman to say what’s happening on the blockchain. That’s a whole lot of trust for a system designed to make trust obsolete.

The situation is even more centralized than Marlinspike lets on, because one company, ConsenSys, owns both Infura and the most popular wallet, MetaMask. Yes, your data lives indelibly somewhere on the blockchain, but in practice, any Web3 app you might use probably relies on these centralized services to access it. As an illustration, Marlinspike writes that when a satirical NFT he created got pulled from OpenSea, it also stopped appearing in his MetaMask wallet, even though it still existed on the blockchain.

Marlinspike notes that Web3 defenders tend to reply to critiques by insisting, “It’s early days still.” It took exactly one day for Vitalik Buterin, the creator of Ethereum, to prove his point. In a response to Marlinspike that he posted on Reddit, Buterin wrote that many of Marlinspike’s points “strike me as having a correct criticism of the current state of the ecosystem, but they are missing where the blockchain ecosystem is going.”

A small faction within the Web3 fold argues that blockchain is getting more attention than it deserves—a medium that has come to stand in the way of the true message, which is decentralization. “I would very strongly say, Web3 is not synonymous with blockchains,” says Jeromy Johnson, an engineer at Protocol Labs, a Web3 R&D organization. Johnson works on blockchain projects, but he also helped code the InterPlanetary File System, a peer-to-peer alternative to the hypertext transfer protocol (that “http://” bit at the front of every web address). Using IPFS prevents content from disappearing from the web just because a certain URL expires or changes. It’s a leading example of decentralized tech that isn’t blockchain.

“There’s a lot of things that people try to use blockchain for that you don’t actually need a blockchain for,” Johnson says. “People try to build social networks on blockchains, and they put every tweet, or whatever they call it, and every ‘like’ on the blockchain, and it’s like, What are you doing? That’s so dumb!”

Johnson worries that blockchain has become a fetish. But I came to Denver wondering whether the same could be said of decentralization itself, as Web3 people understood it. Because the biggest barriers to decentralizing power may not be technological at all.

Centralization is a vague term. One of cryptocurrency’s original aims was to remove intermediaries—banks—from financial transactions. (Hence its appeal among a certain set of libertarians, criminals, and lately Russian oligarchs.) That’s one way to think about centralization: A bank sits at the center of a transaction between two or more entities. But centralization and decentralization can also be framed as a matter of choice: How many options do you have? Is there just one player in the market, or can you shop around? By that standard, the banking industry is pretty decentralized. There are thousands of banks operating in the US alone.

A decentralized technology does not guarantee a decentralized market. Take email. Email is a decentralized protocol. Anybody can, in theory, set up their own email server, but very few people do, as Marlinspike pointed out. Instead, people use email clients, and the market has centralized heavily around a handful of providers, especially Gmail. Even if you personally opt out of Gmail, the person on the other end of every second email you send probably uses it, meaning a copy of your email lives on Google’s servers whether you want it to or not.

Centralization is one word for this; consolidation is a better one. Consolidation is a feature not of technology but of markets. There is a much older protocol for dealing with consolidated markets than Web3. It’s called antitrust law. But government policy does not really figure into the Web3 blueprint.

On the morning the toilets broke, I moderated a panel titled “Why Decentralization Matters.” At one point, one of the panelists, Nick Dodson, an engineer at Fuel Labs, observed that “traditional fintech”—personal finance apps that don’t use blockchains or crypto—is arguably more decentralized than Web3 “because, to be honest, there’s more companies doing things.”

Did you know, I asked, that the fintech sector owes much of its existence to a piece of federal legislation? The 2010 Dodd-Frank Act, passed in the aftermath of the financial crisis, has a section requiring US banks to let customers access their account data in a format that can be read by computer applications. You can thank that provision for the ability to sync up your data with personal finance apps like Betterment and Mint. On the back of this observation, I turned to one of the other panelists, Frankie Pangilinan, an accomplished blockchain programmer. Given the daunting technical challenges facing Web3, I asked, wouldn’t a simpler path to decentralization be for Congress to pass laws mandating data portability and interoperability? Wouldn’t that be easier than trying to iron out the kinks in all this complicated, unwieldy tech?

“Oh my God, what—could you just re-ask that question? I’m so sorry,” Pangilinan said, with the half-smile of someone unsure whether their leg is being pulled. I repeated myself. Wouldn’t a data portability law be easier than the whole Web3 thing?

“Government moves way slower than software does,” she said, with an incredulous laugh. “They’re an archaic system that we’re replacing, essentially.”

Dig Deeper With Our Longreads Newsletter

Sign up to get our best longform features, investigations, and thought-provoking essays, in your inbox every Sunday.Your emailBy signing up you agree to our User Agreement (including the class action waiver and arbitration provisions), our Privacy Policy & Cookie Statement and to receive marketing and account-related emails from WIRED. You can unsubscribe at any time.

Pangilinan was channeling the dominant view within the Web3 movement. Her skepticism is understandable. The internet economy arose during a period of deregulation and historically lax antitrust enforcement. The US government, in particular, has yet to prove itself capable of passing a significant law regulating Silicon Valley or winning a major lawsuit against a platform giant. Congress is, objectively speaking, an archaic system.

And yet law, with all its faults, is still pretty much the most effective technology ever devised for preventing people and corporations from abusing their power—and forcing them to share it. Even within the tech sector, there’s a robust history of government intervention spurring innovation and user choice. Sometimes this comes through dramatic legal confrontations. In the 1950s, antitrust pressure from the federal government forced AT&T and its Bell Labs subsidiary to license out thousands of patents, including one for a little thing called the transistor. Other times, the role of government in decentralizing markets is practically invisible. It’s thanks to a little-known Federal Communications Commission regulation, for example, that Americans get to keep their cell phone numbers when they switch carriers.

But even members of the progressive Web3 community have essentially zero interest in directing their formidable resources toward influencing public policy. They tend to think, instead, as Pangilinan put it, that government is the problem being designed around: just another institution, like Google or Facebook, that demands our trust without earning it.

Later on, I chatted backstage with the third panelist, a former Ethereum core developer named Lane Rettig. He was frank about the shortcomings of crypto and Web3. But he strongly agreed with Pangilinan about the futility of government regulation. Rettig is working on a blockchain called Spacemesh. Unlike Bitcoin or Ethereum, which require tremendous computing power to mine, anyone can mine Spacemesh tokens using spare processing power on their laptop or smartphone, just by downloading an ordinary-looking app—meaning the network could be distributed among millions of participants, rather than the tens of thousands of people who run Bitcoin or Ethereum nodes.

That sounded interesting, so I pulled out my iPhone. Could I download it right then? No, Rettig said; unfortunately, Spacemesh wasn’t available on phones yet. The mobile app hadn’t been built, but even if it had, Apple blocks most crypto-related apps from its App Store. In a call-back to my “regulation is good” routine, I joked that the Open App Markets Act—a bill that has bipartisan momentum in Congress and would force Apple to permit downloading apps not offered in its App Store—would help with that.

Rettig’s eyes lit up. “That’s a bill?” he said excitedly. “That’s huge. I can see that having big implications.”

It’s not quite right to say that crypto people are wholly uninterested in regulation. According to a recent report, the amount spent on crypto lobbying has quadrupled since 2018. But this effort isn’t aimed at using regulation to achieve the goals of decentralized markets or data portability. It’s mostly about blocking new regulations that might stop the gravy train, making sure the state stays out of crypto’s way.

That gravy train has a name: DeFi. Short for “decentralized finance,” DeFi is essentially a crypto betting market, with financial products that allow investors to gamble on cryptocurrencies via options, derivatives, and other avenues. A common one is “yield farming,” which in essence means lending out your crypto in exchange for interest payments. DeFi is big business. The ETHDenver conference may have been a pageant of high-minded ideals, but it was overwhelmingly underwritten by DeFi companies. At any given moment, almost all the most popular Ethereum apps are some form of DeFi platform or exchange. Unlike in traditional finance, these are largely unregulated. If someone steals your money, the bank doesn’t have to pay you back—because there is no bank. This is far from an idle concern. One analysis found that more than $10 billion was stolen from DeFi platforms in 2021 alone.

On my first night in Denver, I headed to a happy hour sponsored by Uma, which bills itself as “a fast, flexible, and secure way to create decentralized financial products.” The event was crawling with DeFi people, each of whom assured me that their product promised super-high yields with minimal risk. Arisa Toyosaki, a former investment banker, told me about the startup she was launching, called Cega. With Cega, she explained, crypto holders will be able to invest in exotic crypto derivatives and generate healthy returns. And, she assured me, it will be nearly impossible to lose money unless the market drops more than 50 percent.

How is this possible?

“I used to do this at investment banks,” Toyosaki said. The DeFi derivative market, she said, “exploded in the back half of 2021.” For the first time, there are enough crypto products to slice and dice into derivatives. To do that well, Toyosaki explained, you need a team of quants who can build advanced statistical models of markets. This was evidently meant to be reassuring. Just in case the parallels to the eve of the 2008 financial crisis were too subtle, my next stop was a performance by the Dutch DJ Tiësto that was hosted by Bacon Coin, a startup that offers mortgage-backed crypto tokens.

Even as DeFi dominated the sponsorships and party calendar, many of the Web3 true believers viewed it with disdain. The rows of tables where crypto companies pitched their wares was labeled the “Shill Zone” on the official conference map. As I was leaving a coffee shop one day, I overheard two guys sitting at a table outside. “I’m not into DeFi,” one said. “Oh,” said the other, “you’re not a Ponzinomics person?” Vitalik Buterin was at the next table, by the looks of it gamely letting someone shill their business to him. Even Buterin publicly worries about the cash grab taking place in the Ethereum universe he created. “If we don’t exercise our voice, the only things that get built are the things that are immediately profitable,” he recently told Time. “And those are often far from what’s actually the best for the world.”

But there’s a paradox. As much as Web3’s dreamers might shun the crypto casino, the fact remains that cryptocurrency—money—is the driving force of what they’re trying to build. This is where all the game theory comes in, along with the other, higher tenets of Web3. It’s also where the Web3 movement breaks with the economic innocence of past waves of internet utopianism.

Back in the early days of Web 2.0, the open source movement—that era’s generation of idealists—was guided by a perhaps naive belief in the willingness of people to volunteer their energies and talents for the greater good. Linux die-hards believed software should be free, recoiling at the profit motive. The platforms born in this era played to that spirit, deploying lofty rhetoric about making the world a better, more open, more connected place—while, in the background, quietly setting up global surveillance operations to spy on their users for the benefit of advertisers.

“A lot of open-web, open source people always thought that money was dirty,” says Julien Genestoux, a veteran of the open source movement who created Unlock Protocol, which seeks to put memberships and subscriptions on the blockchain. “One of the things crypto has been doing is putting money front and center,” he says. “By doing this, it removes the ability of corporate actors to capture the value from everybody else without us knowing. By making it explicit, a thing we’re all staring at, we’re making it harder for the people who want to take it from everybody else.”

At the most basic level, Web3’s approach to financial incentives is an ingenious way of solving new technology’s adoption problem. Let’s say you make a new decentralized platform built on the blockchain, one that works so smoothly that people can use it without getting a PhD in cryptography. Users control their own data and everything is open source. The thing is, those ordinary users probably don’t care much about data ownership or immutable public ledgers. They care about convenience and fun and being where their friends are. So how do you get anyone to use your new Web3 app?

The answer is tokenomics. The business model of nearly every proposed Web3 platform entails distributing tokens to everyone involved, thus incentivizing them to use and improve the platform to make the value of those tokens go up. In Web3-speak, this is called “aligning the incentives.” The concept has its roots in Bitcoin, whose pseudonymous creator, Satoshi Nakamoto, devised a set of rules to prevent conflict between an individual’s self-interest and the interests of Bitcoin. Using game theory principles, Bitcoin could incentivize everyone to act for the collective good. Even if someone took control of enough of the network to be able to rewrite its history and inflate their account, they would have a powerful reason not to: Such treachery would kill confidence in Bitcoin and thus crater the value of their own holdings.

Many people see Bitcoin and other cryptocurrencies as pyramid schemes, since their value is a pure function of there being someone else who wants to buy in. But tokenomics can, at least theoretically, serve a useful purpose out in the real world. Take Presearch, a Web3 search engine. Presearch is distributed across a network of nodes that anyone can set up on their computer or a virtual private server. Your search term gets passed to one of the nodes, which queries a range of sources before returning a response. People who run nodes are rewarded in the form of PRE tokens, Presearch’s custom crypto coin. Users can also be rewarded with tiny micropayments of the token for performing searches. As the platform gets more popular, the tokens should become more valuable. That value has a real-world reference point: Advertisers have to buy tokens in order to appear above search results. Will this work? Perhaps not. But it’s not a Ponzi scheme.

Web3 apps promise not just to pay users but to give them a say in how the platforms are run. In the case of Presearch, for example, the PRE token will confer ownership and some kind of governance power over the platform. In theory, that distributed structure should prevent anyone from pushing Presearch in any shady or exploitative directions. “Why are we not going to end up like Google?” says Presearch’s founder, Colin Pape, referring to the search giant’s well documented privacy issues. “Because we have everyone aligned around this one value unit, and if we try to extract too much value from users, and they get pissed off, the value of the token goes down.”

That sounds plausible in the abstract, but it raises all sorts of practical questions. How do you keep someone from buying enough tokens to exert unilateral control? How do you know the crypto accounts holding tokens belong to separate human beings? If you do manage to keep things decentralized, how will you act quickly enough to compete with traditional businesses that don’t have to put every single decision to a vote?

The answers are all speculative, because none of that governance stuff actually exists yet. Pape admits that decentralized control remains an aspiration for Presearch. The reality is that the company, meaning Pape, controls the search engine, just like Alphabet controls Google. This is something of a theme in the Web3 world. Everyone has a white paper spelling out how their new platform will be governed by “the community” … eventually, ultimately, at some future point yet to be determined, once a whole bunch of other issues are sorted out and the platform gets big enough to remove the training wheels. Oh Lord, give me decentralized control, but not yet.

If the vision of collectively run mega-platforms sounds implausibly far out, the highest tenets of Web3 are somehow even more ambitious. Using blockchain technology and tokenomics to get people to buy into a set of decentralized apps? That’s just the beginning. For some Web3 luminaries, the real goal is to use cryptocurrencies to lock human beings into a more cooperative, less self-destructive society. I didn’t fully understand this until I met Kevin Owocki.

Few people are trying harder to turn the idealism of Web3 into reality than Owocki. A resident of Boulder County, near Denver, Owocki is the founder of GitCoin, a platform for funding open source Web3 projects that has raised and distributed roughly $60 million so far. He was one of the most Colorado of the many Colorado guys on hand at ETHDenver, with long hair past his shoulders, a trim beard, and an athletic build. At one point, when I said I was thirsty, he pulled a can of kombucha out of his back pocket and handed it to me.

Owocki was something of a rock star at the conference. He is credited with coining the term BUIDL in 2017. Admirers approached him nonstop to talk, express their support, or ask for a copy of his book, GreenPilled: How Crypto Can Regenerate the World, which was the talk of the conference and quickly sold out of the 400 copies he had ordered. Owocki is about as far from a casino person as you’ll find in the crypto world. In one of several presentations he gave, Owocki told the crowd that since research shows money stops increasing happiness after about $100,000 in annual income, Web3 founders should maximize their happiness by giving their excess money to public goods that everyone gets to enjoy. “There’s cypherpunk, which is all about privacy, decentralization: hardcore libertarian shit,” he told me. “I’m more of a leftist. I’m more solarpunk, which is, how do we solve our contemporary problems around sustainability and equitable economic systems? It’s a different set of values.”

The internet, he explained, made it possible to move information between computers. This revolutionized communication. Blockchains have made it possible to move units of value between computers. Owocki believes this can be harnessed to revolutionize how human beings interact through something he calls “regenerative cryptoeconomics.” Cryptoeconomics, he writes in GreenPilled, “is the use of blockchain-based incentives to design new kinds of systems, applications, or networks.” Regenerative cryptoeconomics means doing this in a way that makes the world a better place for everyone. The goal is to break free from the zero-sum, rich-get-richer patterns of capitalism. Owocki believes that the right cryptoeconomic structure can help solve collective action problems like climate change, misinformation, and an underfunded digital infrastructure.

The key tool for achieving this is a decentralized autonomous organization. In theory, a DAO (yes, pronounced the same as the ancient Chinese word for the way of the universe) uses cryptocurrency to boost collective action. Typically, members join by buying some amount of a custom token issued by the DAO. That entitles them to an ownership stake in the DAO itself. Member-owners vote on what the DAO does—which is mostly to say, what it spends money on, since a blockchain-based entity can do little besides move funds from one address to another.

The young concept already has a checkered history. The first DAO, named simply “The DAO,” collapsed in 2016 after someone exploited a loophole in its code to siphon off what was then worth some $50 million in Ethereum currency. Similarly colorful failures have followed. DAOs were nonetheless all the rage at ETHDenver, where attendees waxed on about their world-changing potential. Kimbal Musk, Elon’s photogenic brother, spoke about his Big Green DAO, a food-related charity. Giving away money via a DAO, he insisted, got rid of all the painful bureaucracy of philanthropic nonprofits. “It’s way better,” he said, though he also granted that “there are many ways to fail, and this one could fail spectacularly.”

What is it about a DAO that—unlike, say, a Kickstarter page—frees humanity from the collective action problems that threaten to doom the species? According to Owocki, it’s the ability to write code in ways that tinker with incentive structures. (In this sense, the first DAO was arguably Bitcoin itself.) “Our weapon of choice is novel mechanism designs, based upon sound game theory, deployed to decentralized blockchain networks as transparent open source code,” he writes in GreenPilled. Indeed, the book has very little to say about technology, per se, and much more to say about various game theory concepts. These range from the sort of thing you’d learn in an undergrad econ class—“public goods are non-excludable and non-rivalrous”—to things that wouldn’t be out of place in a sci-fi novel: “community inclusion currencies,” “fractal DAO protocols,” “retroactive public goods funding.”

One of the most powerful incentive design techniques, according to Owocki, is something called quadratic voting. Standing near the edge of the Shill Zone, Owocki turned around to show me the back of his purple baseball jacket, which said “Quadratic Lands.” The Quadratic Lands, Owocki explained, are a mythical place where the laws of economics have been redesigned to produce public goods. “It’s just a meme,” he said. “I don’t want to tell you it already exists.” (Everyone at ETHDenver was concerned, rightly, about my ability to separate metaphorical claims from literal ones.)

In a quadratic voting system, you get a budget to allocate among various options. Let’s say it’s dollars, though it could be any unit. The more dollars you allocate to a particular choice, the more your vote for it counts. But there’s an important caveat: Each marginal dollar you pledge to the same choice is worth less than the previous one. (Technically, the “cost” of your vote rises quadratically, rather than linearly.) This makes it harder for the richest people in a group to dominate the vote. GitCoin uses an adaptation, quadratic funding, to award money to Web3 projects. The number of people who contribute to a given project counts more than the amount they contribute. This rewards ideas supported by the most people rather than the wealthiest: regenerative cryptonomics in action.

Glen Weyl, the polymathic Microsoft researcher who came up with quadratic voting, is far more cautious than Owocki about its applicability to blockchain. In a foreword to Owocki’s book, he writes, “I am deeply ambivalent about Web3.” He has positioned himself as a sort of insider critic of the movement, one who supports its broad goals of decentralization and digital public goods but questions its faith in the potential of blockchains and cryptocurrencies in their current state.

Weyl walked me through the weaknesses of using quadratic voting in a DAO. A major problem is Sybil attacks, in which one person creates a thousand “sock puppet” accounts and uses them to take over the voting. Even if you come up with a solution to the proof-of-identity problem so that it’s hard to make duplicate accounts, someone could just get people in the analog world to create accounts on their behalf. Imagine, Weyl said, if the Chinese government wanted to take over a DAO. All it would have to do is instruct its citizens to join and hand over control of their wallets.

Owocki believes he and his co-revolutionaries can sort out these problems. He asked if I’d heard of the Matthew Effect, which, he explained, is how economists refer to the fact that the rich tend to get richer. “It’s a fundamental law of economics,” he said, but that doesn’t mean it’s unbeatable. Conquering laws of nature is what technology is for. “An airplane upends gravity; what if you can build an economic system that upends the Matthew Effect? Dude, quadratic voting is it.”

All of this is getting a little heady for me. Never mind the furthest reaches of Owocki’s theory; it’s hard enough for me to grasp how a DAO is supposed to work. So while I’m in Denver, I decide to create one.

My friend Jacksón Smith works for a nonprofit called Learning Economy Foundation that researches the use of blockchain in education. He’s at the conference and agrees to help me create the DAO. We settle on an admittedly low-stakes idea: Our DAO will try to win The New Yorker magazine’s weekly cartoon caption contest, in which readers compete to supply the wittiest punch line to a captionless cartoon. Each week, the DAO members will vote on each other’s submissions and submit the internal winner to the actual contest. We call it lmaoDAO.

I put in serious hours on the DAO over the weekend, but not as many as Jacksón and a couple of his coworkers, who actually know how to program and generously volunteer time to build it, and whom I half-jokingly start referring to as “my core devs.” I should say, to BUIDL it. We’re BUIDLers, officially hacking together a Web3 application in the spirit of ETHDenver. I am somewhat surprised to find that, when I explain what I’m doing, people at the conference are unfailingly supportive. I thought they might take exception to a journalist creating a DAO as a stunt, an act of mild trolling, but the general sense is that we’ve come up with a clever idea.

Two things become very clear as we create the DAO. First, a DAO is nothing more than a group whose membership requires owning a crypto token—in our case, a custom LMAO coin that we mint out of thin air. Like most DAOs, ours is organized on Discord, a Web 2.0 application. Our DAO isn’t really decentralized; we control the Discord, Jacksón controls the voting website, and I manually submit the captions to NewYorker.com. We've committed in principle to building out decentralized governance, but who knows when that will happen. In the meantime, everyone else has to trust that we’re doing what we say we are.

The second thing that becomes clear is that BUIDLing is really fun. Setting up a DAO is a bit like designing a video game. You have to create incentives and rules that will keep people playing and can’t be easily exploited. In fact, it feels like a game within a game, because Web3 itself is not unlike an immersive RPG—an alternate reality with its own rules, customs, and language. Play for long enough and you stop having to check the instructions. All kinds of esoteric jargon starts making sense. Switch your wallet from the Ethereum mainnet to the Gnosis chain to claim your LMAO tokens. Sync your tokens with the collab.land Discord bot to prove you’re a member and get access to the locked Discord channels.

The real fun of BUIDLing lies in the problem-solving. How will we get people to join, for example? Nathan, one of my devs, comes up with an idea: He can scrape every crypto wallet that holds either a Bufficorn NFT or ETHDenver meal tokens, and use that as a proxy for people who attended the conference. Then we can “airdrop” our custom token to everyone on that list. Most intoxicatingly, this all takes place in a relatively closed system. Very few of these decisions require us to think much about the messy world outside the confines of our DAO. It all helps me understand the draw of Web3. The sense of moral valor that once accompanied working in Web 2.0 is harder to find these days. Whatever else Web3 is, it’s a realm where coders and technologists can reconnect with the joy of hacking, where they can feel good again about working in tech. Jacksón, who in fact builds elaborate board games as a hobby, tells me that escapism is part of Web3’s appeal. The question is whether the escape hatch leads to a real place or a fantasyland.

As those pizza crusts and empty snack bags pile up, I realize that it’s Saturday evening, and dinnertime is approaching. There’s a rumor that Snoop Dogg, who recently announced his intention to turn Death Row Records into an NFT music label, is throwing a party somewhere. But I have plans to meet up with my childhood friend Dave, who lives in Denver.

As Dave and I catch up over tacos and margaritas, I feel slightly crazed, struggling to explain what I’ve been up to: Web3, cryptoeconomics, BUIDLing a DAO. I’m a bit like Dorothy returned from Oz. Gradually, talk drifts to normal stuff: his family, my job, a trip we’ve been planning. That night, I sleep in Dave’s basement, and on Sunday morning I’m woken early by the patter of his 2-year-old daughter’s feet. The guys at the conference seem to really believe they’re building a better world for her, but in the morning light it’s hard to take seriously the idea that her future depends on precisely calibrating a bunch of incentives in a blockchain membership organization. It all feels like a game that I’ve unplugged from.

Then my phone buzzes. My services are needed before the DAO can officially launch. Without thinking much of it, I plug myself back in.

Source: Wired