The biggest GameFi-related news of the past fortnight has most certainly been the cross-chain bridging hack that saw more than US$550 million worth of funds drained from the Axie Infinity project and ecosystem via the Ronin blockchain. To get his quick take on it, we caught up again with Sergei Sergienko, the Sydney-based co-founder of gaming guild Crypto Gaming United (CGU)

Most GameFi projects by active users: From Splinterlands, Alien Worlds to Axie Infinity

Time for a look at how the leading blockchain gaming projects have been faring over the past seven days. Plus, some fresh GameFi news and an Axie-hack discussion with Sergei of Crypto Gaming United.

Top GameFi projects by active users

| Game | Active Users, past 7 days | Change |

| 1. Splinterlands | 509k | -5% |

| 2. Alien Worlds | 476k | +23% |

| 3. MOBOX: NFT Farmer | 179k | +20% |

| 4. Upland | 152k | +14% |

| 5. Farmers World | 133k | +10% |

| 6. Defi Kingdoms | 67k | -13% |

| 7. Sunflower Land | 62k | +4,037% |

| 8. Galaxy Blocks | 61k | +163% |

| 9. SecondLive | 60k | +11% |

| 10. Axie Infinity | 59k | -4% |

Source: dappradar.com

NFT card game Splinterlands and the space-metaverse strategy game Alien Worlds have been dominating the GameFi sector in terms of active users so far this year.

The most notable movers into this list over the past day or so, however, are “play-to-own” crypto-farming game Sunflower Land and the ultra-simplistic block-busting game Galaxy Blocks.

Meanwhile, still the biggest play-to-earn game by market cap, Axie Infinity looks like it might slip back down out of the active users top 10 weekly list any day now.

It seems not even the launch of its new update, Axie Infinity: Origin, or the fact its users are being reimbursed losses after the Ronin Validator hack can stop the project from dipping for the moment. Axie tokens AXS and SLP are both down more than 30 per cent over the past seven days, too.

To be fair, though, many crypto projects have been experiencing something of a slide over the past week or so as macroeconomic-influenced bearish sentiment takes hold.

Top GameFi projects by market cap

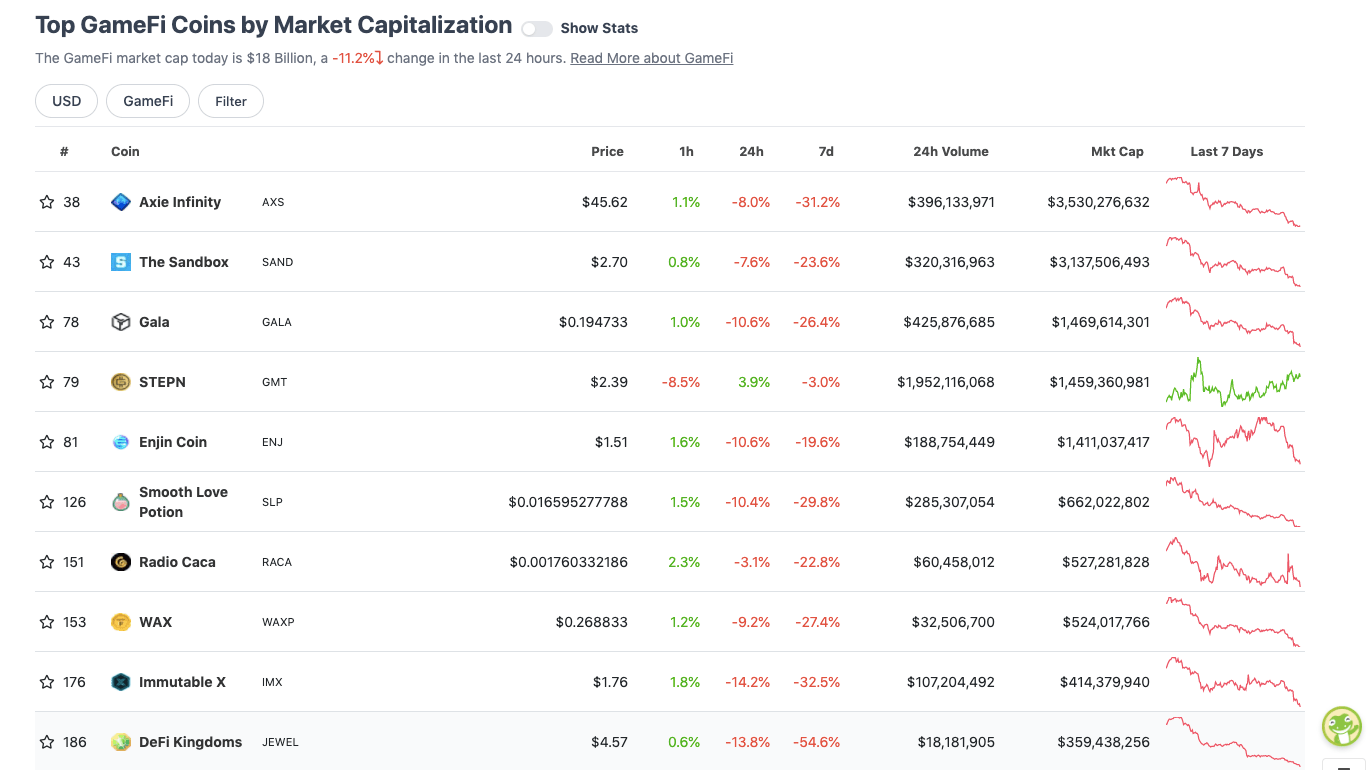

Meanwhile, according to CoinGecko, here are the top 10 GameFi coins by market capitalisation at the time of writing…

Source: coingecko.com

The Aussie-founded “move-to-earn” project STEPN is still one to watch in this arena. Less a “game” and more a fitness project, it nevertheless incorporates GameFi-style tokenomics.

The Axie hack – Crypto Gaming United’s take…

The biggest GameFi-related news of the past fortnight has most certainly been the cross-chain bridging hack that saw more than US$550 million worth of funds drained from the Axie Infinity project and ecosystem via the Ronin blockchain.

To get his quick take on it, we caught up again with Sergei Sergienko, the Sydney-based co-founder of gaming guild Crypto Gaming United (CGU)…

How’s it going, Sergei? Axie Infinity… what happened there?! Were you shocked by that? Does it raise concerns for you about the safety of GameFi, or at least cross-chain bridging protocols?

SS: Good thanks. It was unexpected and crazy… And I think it just shows that pseudo-decentralisation is not good.

In other words, when there are only nine validator nodes, and five nodes are needed to sign transactions, then you have a problem.

The most interesting question, though, is how the f**k has the hacker got control of those five nodes? It’s very difficult to do if normal digital security hygiene was followed. Bridges are always a weak link, though.

CGU’s Sergienko is also the CEO of blockhain/fintech company Chrono.tech. (Photo: supplied)

Do you think Axie Infinity is strong enough to bounce back from the largest hack in GameFi/DeFi history?

SS: Axie have shown themselves to be quite resilient, but I’m not sure if this one is quite enough to recover from. Its a big deal… What’s comforting is that Binance has stepped in and invested US$150 million to recover the losses, at least partially. At least that shows us hope.

Maybe the new Axie Infinity: Origin update will help grow the game and bring in more users?

It’s possible, although it’s very difficult to recover from something like that. But, I still believe in the Axie team and hope that they will pull something out of the hat. There are a lot of competitors coming on, quickly, though.

How’s CGU going, by the way? Any updates you want to share?

CGU is going strong. And as expected, our players are becoming more professional as they are the ones making money at the moment as the gaming dynamic has changed.

Our theory that games are, in fact, a gateway for people into the Web 3.0 environment is proving to be correct. We see people exploring other options to earn money in Web 3.0, not just games. Thats exciting and that’s exactly what we’ve hoped to see.

GameFi news: Shrapnel; Ubisoft; Animoca Brands

• Shrapnel, a sci-fi first-person shooter (FPS) game built on the Avalanche blockchain, has completed a US$7 million token sale that included participation from Dragonfly and Three Arrows Capital, as well as angel investors Keith Nunziata of Citadel Global Equities and Jason Zhao at Kleiner Perkins.

Shrapnel is being developed by Neon Games – a spin-off studio from HBO Interactive that consists of a BAFTA and Emmy award-winning team of industry veterans hailing from some of the world’s leading game companies including Xbox, Electronic Arts and LucasFilm.

Some serious chops right there. Neon raised US$10.5 million in an October seed round led by Griffin Gaming Partners alongside Polychain Capital.

The game is being touted as the first AAA blockchain-enabled “moddable” FPS, giving players and users scope and freedom to alter and take the game in creative directions.

Stockhead will be digging into this one a bit further and chatting with the game’s developers later in the week…

Ubisoft delves deeper into blockchain

French game developer Ubisoft, publisher of titles including Assassin’s Creed, Far Cry, For Honor has led a US$60 million investment in White Star Capital’s new Digital Asset Fund.

The fund will focus on small and medium-size crypto companies working towards the mass adoption of digital assets.

In late March, Ubisoft teamed up with the noted blockchain games studio Animoca Brands, backing the free-to-play game Cross the Ages in a seed-investment round worth US$12 million.

Ubisoft also dipped its toes into the non-fungible waters last year, creating an NFT platform dubbed Ubisoft Quartz, as well as a tech lab for experimenting with blockchain with the aim of shifting towards… you guessed it… the metaverse.

Animoca turbocharges into crypto racing games

And speaking of Animoca Brands, the company has now completed its acquisition of French firm Eden Games, publishers of the Gear Club and Test Drive series, as well as other popular racing games.

Canada’s Engine Gaming and Media sold its 96% stake in Eden Games to Animoca for US$15.3 million last week.

Animoca plans to enhance its REVV Motorsport (REVV) ecosystem by taking a “metaverse first approach” to new and existing gaming titles, according to a Twitter thread from CEO Yat Siu.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article. At the time of writing, the author holds several crypto assets, including Bitcoin and Ethereum.

Source: stockhead